2022 Benefits

Medical Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the 1st day of the month following date of hire (for exempt employees), or on the 1st day of the month following 30 days of employment (for non-exempt employees).

Summary of Benefits and Coverages

HCP Packaging offers three medical plans for employees to choose from – Gold, Silver and Bronze. These plans offer varying deductibles, out of pocket maximums, coinsurance and co payments for services depending on which plan is selected.

The chart below provides a high level overview of the medical plan design and features.

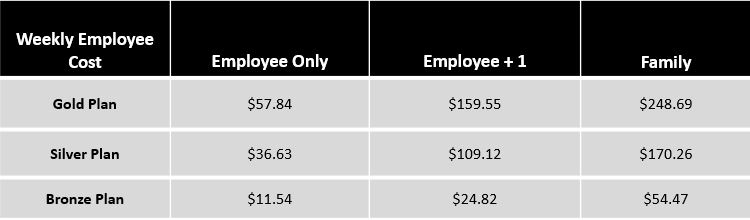

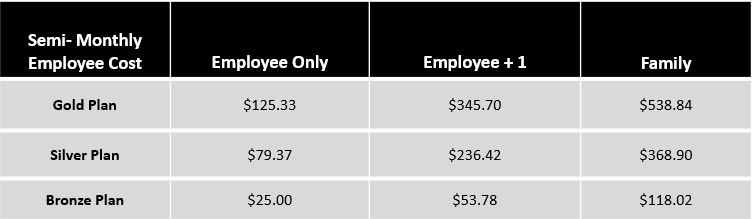

Contributions & Rates

Carrier Contact Information

Cigna: Medical Insurance

Customer Service: 800-244-6224

Website: www.mycigna.com

Click here for the Cigna Provider Directory

Click here for the Cigna Formulary Drug List

Documents

Recorded Video Overview of Cigna’s Medical Plans

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Additional Information

Telehealth Benefits

Employees enrolled in the medical plans offered by HCP Packaging can access telehealth services to treat minor medical conditions like colds, flus, sore throats, allergies and more. Cigna’s telehealth services allow employees to connect with a board-certified doctor via video or phone. Any payments for these services are automatically applied to the out-of-pocket maximum under your plan. For more information or to register for telehealth services go to www.mdliveforcigna.com

Help Center Contact Information

![]()

MD live for Cigna: Telehealth Benefit

Customer Service: 888-726-3171

Website: www.mdliveforcigna.com

Flexible Spending Accounts

Flexible Spending Accounts

Flexible Spending Accounts provide you with an important tax advantage that can help pay healthcare and dependent care expenses on a pre-tax basis. By anticipating health care & dependent care costs for the next year & setting aside money, employees can lower their taxable income and pay for qualified expenses. FSA and DCA accounts are administered by HRC Total Solutions.

Flexible Spending Medical Account (FSA)

In 2022, the maximum an employee can contribute to an FSA is $2,850.

This program allows employees to use pre-tax dollars for IRS-approved expenses such as medical deductibles, copayments/coinsurance, prescription copays, hearing aids, and dental services.

Dependent Care Account (DCA)

In 2022, the maximum amount an employee can contribute to a DCA is $5,000 (for single or married filing jointly) or $2,500 (if married and filing separately).

The DCA allows employees to use pre-tax dollars to fund qualified dependent care such as daycare for children under age 13 or elder care.

HRC Total Solutions – Set up your Online Account

Employees who participate in an FSA and/or a DCA will be issued a debit card to pay for eligible expenses, or they can pay out-of-pocket and submit a claim form for reimbursement. Employees will be responsible for managing their FSA accounts on the HRC Total Solutions website.

For instructions on retrieving your username, creating an account password, and entering new user security questions to complete your online account profile, please go to our online account set-up page at the link below.

Please note: your online account will be available within 30 days of your plan effective date. If you already have an account you can login at the link below.

HRCTS Mobile App

You can download the HRC Total Solutions App and check your balance and final filing date, submit claims, and upload receipts on any android or iOS device. You can view all claims requiring receipts, and submit new receipts by taking a picture with your mobile device.

Automatic Phone System

You can access your available balance, final filing date, final service date, eligible amount, and your most recent transactions all from a toll-free automated phone service. This service is available 24/7 to all participants enrolled in an FSA or DCA plan. Just select option 6 when calling HRCTS, or you can reach the service directly by calling 877-415-8093. Please note, you will need to have a phone number on file in your online account, along with your zip-code to access this service.

Contributions

Made By Employees

Carrier Contact Information

HRC Total Solutions: Flexible Spending Accounts

Customer Service: 603-647-1147 / FAX: 866-978-7868

Website: www.hrcts.com

Email: customerservice@hrcts.com

Forms and Plan Documents

Additional Information

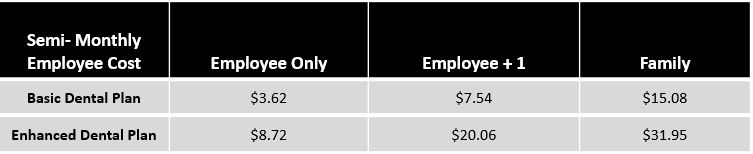

Dental Benefits

Eligiblity

All employees who work a minimum of 30 hours per week are eligible for coverage on the 1st day of the month following date of hire (for exempt employees), or on the 1st day of the month following 30 days of employment (for non-exempt employees).

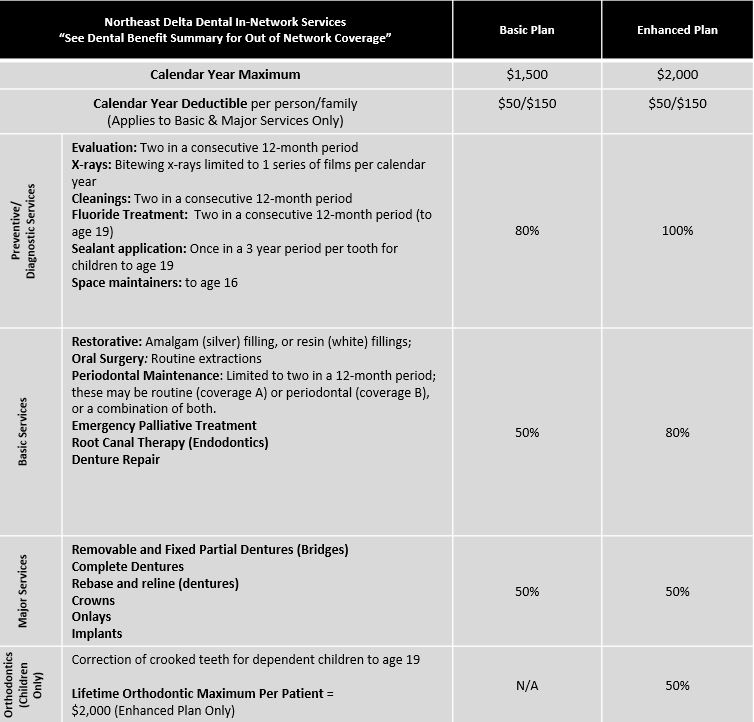

Summary of Benefits and Coverages

HCP Packaging offers benefit eligible employees the choice between two dental plans which have varying coverage levels through Northeast Delta Dental.

The chart below provides a high level overview of the dental plan design and features.

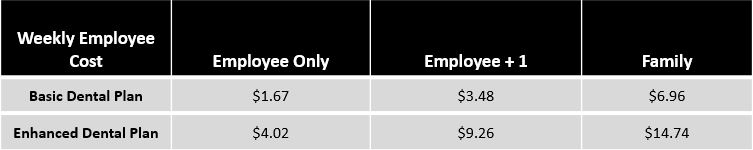

Contributions & Rates

Carrier Contact Information

Delta Dental: Dental Insurance

Customer Service: 1-800-832-5700

Website: www.nedelta.com

Please click here for the Northeast Delta Dental Provider Directory

Forms and Plan Documents

Recorded Video Overview of Delta Dental Plans

Vision & Hearing Benefits from Delta Dental

Helpful Videos from Delta Dental

Additional Information

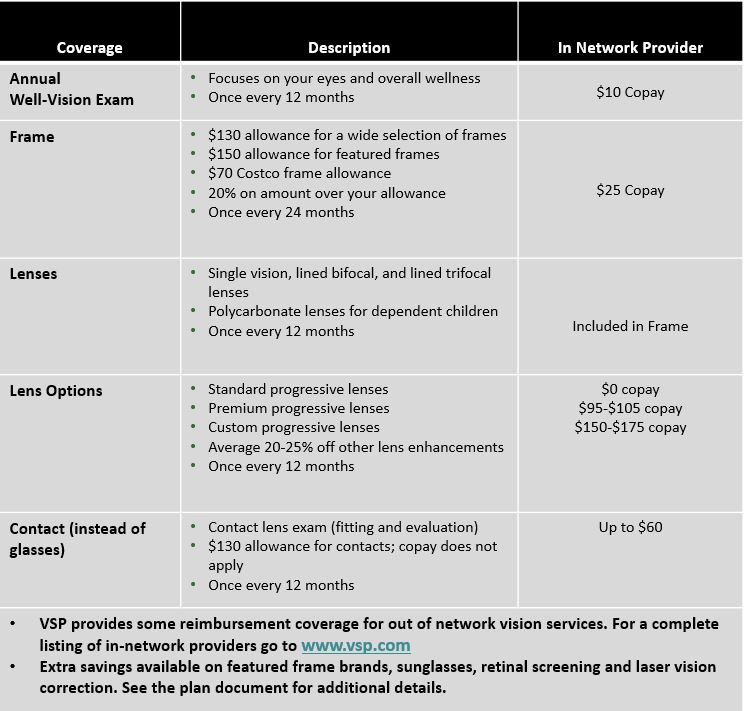

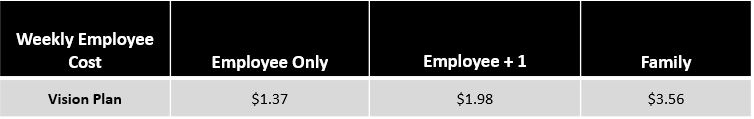

Vision Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the 1st day of the month following date of hire (for exempt employees), or on the 1st day of the month following 30 days of employment (for non-exempt employees).

Summary of Benefits and Coverages

HCP Packaging offers employees vision coverage through VSP.

The chart below provides a high level overview of the vision plan design and features.

VSP provides some reimbursement coverage for out of network vision services. For a complete listing of network providers go to www.vsp.com

Extra savings available on featured frame brands, sunglasses, retinal screening and laser vision correction.

Please see plan document linked under Forms and Plan Documents for additional details.

Contributions & Rates

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Click here for the VSP Provider Directory

Forms and Plan Documents

Basic & Voluntary Life Benefits

Eligibility

All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following 30 days of employment.

Summary of Benefits and Coverages

HCP Packaging provides benefit-eligible employees with the core benefits of life insurance and accidental death & dismemberment insurance. In addition to these core benefits, employees can supplement their plans by purchasing voluntary life insurance to cover themselves and their families.

Below is an outline of the coverages available under each plan.

Basic Term Life & AD&D Insurance:

- 100% funded by HCP Packaging

- Coverage is equal to 1x earnings to a maximum of $125,000

- At age 65, original benefit amount will be reduced by 35%; at age 70 by 60% and at age 75 by 75%

Voluntary Life & AD&D Insurance:

- 100% employee funded

- Eligible employees may purchase coverage on themselves from $10,000 up to $300,000 in increments of $10,000 (not to exceed 3x their annual earnings); Guaranteed issue amount: $60,000

- Employees may purchase coverage for their spouse from $5,000 up to $100,000 in increments of $5,000 (can not exceed 50% of employee coverage amount); Guaranteed issue amount $30,000

- Employees may purchase coverage for their dependent children in the amount of $10,000 for each child age 6 months to age 26; No medical information is required

Carrier Contact Information

The Hartford: Life, Optional Life & Disability Insurance

Customer Service: 800-523-2233 (Life, Optional Life, LTD & STD)

Website: www.thehartford.com

Contributions

Basic Life & AD&D is 100% paid for by HCP Packaging.

Voluntary Life & AD&D is 100% paid for by the employee. Premium costs are based on the amount of coverage approved and the age of the participant.

Forms & Plan Documents

Long-Term & Short-Term Disability

Eligibility

Long-Term Disability: All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following 90 days of employment.

Short-Term Disability: All employees who work a minimum of 30 hours per week are eligible for coverage on the first day of the month following 90 days of employment.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by the employee

- Elimination period: 180 days

- Monthly benefit is 60% of pre-disability income to a monthly maximum of $5,000

Short-Term Disability Insurance:

- 100% funded by HCP Packaging

- Weekly benefit is the lesser of 50% of pre-disability earnings or $300 per week

- Payment of benefits begin on the 1st day in the event of an injury; or on the 8th consecutive day of disability in the event of an illness

- Benefits will be paid up to maximum of 26 weeks in the event of an injury or illness

Carrier Contact Information

The Hartford: Life, Optional Life & Disability Insurance

Customer Service: 800-523-2233 (Life, Optional Life, LTD & STD)

Website: www.thehartford.com

Contributions

Short Term Disability Insurance is 100% funded by HCP Packaging.

Long Term Disability Insurance is voluntary and 100% funded by the employee.

Plan Documents

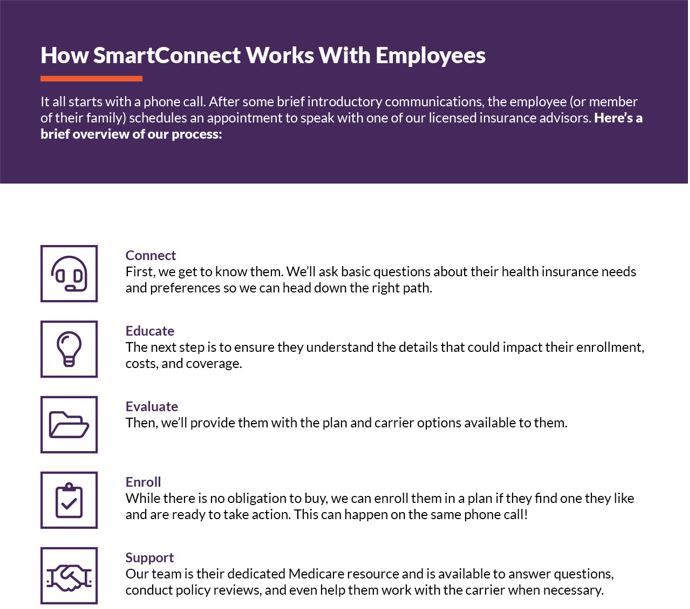

SmartConnect - Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/therichardsgroup

Additional Information

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by HCP Packaging

Program Details

The EAP is a confidential assistance program offered by HCP Packaging at no cost. This program offers support, guidance and resources to help you and your family find the right balance between your work life and your home life.

EAP services are available to all employees, and their immediate family members through ESI Group. This is a completely confidential counseling program that covers issues such as marital & family concerns, depression, substance abuse, grief & loss, legal assistance and financial assistance.

EAP Contact Information

ESI Group: Employee Assistance Program

Phone#: 1-800-252-4555

Website: www.theEAP.com

401(k) Retirement

Eligibility

Employees who are at least 18 years of age and have completed 3 months of service with HCP Packaging are eligible on the first day of the month following 3 months of service.

Program Details

Please click on the buttons below for further information and forms for the 401(k) Profit Sharing Retirement Plan offered by HCP Packaging.

Contact Information

Principal: 401(k) Retirement

Phone#: 1-800-547-7754

Website: www.principal.com